EV Cold Start Problems - India

Before we begin to discuss the challenges, let us introduce ourselves to the various stakeholders in this ecosystem

EV Value Chain stakeholders

- Cell Manufacturer

- Production of cells from raw materials & other inputs (labour, technology)

- Battery Assembler

- Assembly of cells into integrated battery packs with BMS

- OEM

- Assembly & manufacture entire vehicles including HW & SW components

- Dealer

- Carry out sales of vehicles to buyers

- Charging Point operator

- Usually individual stakeholders like station owner, kirana stores, etc

- Charging Network Operator

- CPO aggregators & managers

- Financier

- Financing for the end customer

- Vehicle owner

- Final buyer - individual owner, fleet operator, logistics company, etc.

Challenges - circa 2022

Now let us take a look at the challenges we faced circa 2022. We will then discuss how far we have come from the scenario then to present day (2025)

Lack of good vehicles available

- Given the software aspect coupled with India specific problems, a lot of R&D is required to build a good vehicle suited for the country

- Cost of an EV is much higher compared to ICE offerings

- Customers were also just getting familiar with EVs & most buyers were still first adopters

- As volumes were low not many models were available

- Most major OEMs did not offer EV powertrain models, or just 1 EV model across its entire range in India

- Due to lack of choice, many customers shied away

Lack of component manufacturers

- Most components (outside of battery pack) have a dependency on China. This makes it harder for OEMs to claim available subsidy.

- As domestic demand was low, local production didn't have the necessary volumes & access to advanced technologies

Lack of Charging Infrastructure

- Range Anxiety - more of a fear of not finding chargers vs running out of charge >>Lower sales >>Less attractive for Infrastructure

- Bulk of India's charging is setup as slow charging

- Currently, most charging is happening at homes or offices using private chargers

- Mom & Pop CPOs are emerging, but they lack very large aggregator platform for demand generation

- Some use cases are being solved with swapping, mostly1 in 2W & 3W segment

- FAME II has reinitiated focus on fast charging Infra

Lack of Financial Options

- Not enough vehicles sold to create data on secondary market for underwriters to understand & quantify risk

- Earlier experience with EVs propagated a feeling that EVs had poor longevity, which made underwriting unattractive and non viable for financial institutions

- Major financial institutions are yet to offer attractive finance plans

- A bulk of the financing is done by NBFCs and other smaller finance players

Lack of Recycling Ecosystem

- Insufficient collection infrastructure, linked to ‘extraction’ centers can hinder the effective collection and recycling of used batteries.

- The existence of several types of Li-ion batteries, each with its own distinct design, makes it difficult to establish recycling centers that could cope with the full range of Li-ion batteries.

- Li-ion batteries intended for EVs are typically quite large, with increasingly voluminous battery packs, making disassembly more complex and potentially riskier.

- Except for cobalt and nickel, most of the other constituent materials are more costly to salvage than simply to mine directly.

- Supply of lithium-ion batteries from mobiles and laptops is not enough to setup a large recycling facility.

- Accurate identification and sorting of various battery chemistries and types can be challenging, requiring advanced technologies and expertise.

- EVs have been in the market for the last 4-6 yrs only, most of the batteries have not yet reached their recycling stage yet.

Current Scenario

Let us take a look at the current scenario (2025)

Vehicles available

- With rising consumer interest, more models are being launched across the categories & companies

- Today one has multiple choices at each category & price point

- EVs are are also nearing cost parity with ICE when compared to 2022

- More Indian startups and companies are carrying out R&D & development of new EVs

- Legacy multinational OEMs are also investing in local R&D

Component manufacturers

- Most components are now locally manufactured

- We have moved from simple pack manufacturing to R&D & manufacturing of sophisticated battery packs & BMS systems locally

- Save for a few categories like motors, controllers & mass manufactures BMS systems, we have overcome our dependence on foreign imports and hence sped up the supply chain logistics and cost economics

Charging Infrastructure

- Increasing market penetration of EVs has also led to the development of better Charging Infra

- Power utilities are now offering dedicated EV charging meters for residential consumers with attractive charging rates and unlimited

- OEMs, power utilities and new startups are consolidating and tying up to offer larger networks of chargers though no one charging aggregator or charging station company offers a truly pan-India network even today

Energy Consumption in India

- Current : 1282 TWh

- Total Money Spent : $102 Bn

Energy to be consumed for EV charging

- 2023 - 2961 GWh

- 2030 - 53.3 TWh

EV Charging Cost

- 2023 - $235 Mn

- 2030 - $6.2 Bn

Financial Options

- IDFC First now offers interests as low as 5.99% on the purchase of Ather scooters

- With higher quality of vehicles and better components, underwriting of the vehicle is easier

- Availability of on-ground operating data (powered by data connectivity and higher penetration) allows more accurate underwriting.

- Rise of large banks such as HDFC, ICICI, Kotak already offer competitive interest rates

- Access to financing is largely solved and we see a uptick is EV purchase with this as an anchor

Recycling Ecosystem

- We now have more companies in this space with a few having started production facilities for the same

- They have built partnerships with OEMs to recycle and supply them with Raw materials

- There is still a lot of potential for growth as most 1st generation vehicles' batteries are yet to reach end-of-life

Charging

Types of Chargers

| Charging Point | Slow Charger | < | Fast Charger | < | < | |

|---|---|---|---|---|---|---|

| Level | LAC | Bharat AC-001 | Bharat DC-001 | Type-2 AC | CHAdeMO | CCS |

| AC/DC | AC | AC | AC/DC | AC | DC | DC |

| Power Range | <3kW | 10 kW | 15 kW | >22kW | >50kW | >50kW |

| Rated Voltage V | 230 | 230 | 72-200 | 380-480 | 200-1000 | 200-1000 |

| Cost | Rs 6500 | Rs 65,000 | Rs 2.47 L | Rs 1.2 L | Rs 13.5 L | Rs 14 L |

| Vehicles | 2W, 3W, Cars | 2W, 3W, Cars | 2W, 3W, Cars | 2W, 3W, Cars | Cars & Buses | Cars & Buses |

Need for Capacity Augmentation

- Space -Most vehicles park on roads >> friction to install a charging point

- Charging points require a significant amount of land area >> mixed usage of land >> repurposing of existing parking land is required

- Regulation - Unbundling of power distribution is yet to happen

- The electricity distribution system in India is not ideal to support a fast adoption of EVs

- Capacity -in densely populated cities, with moderate adoption of EVs in 5 years, there will be a 20% increased load on the distribution network and it can go back up to 50%

- Utility processes are not agile enough >> Ability to serve on-demand capacity for fast charging points (sat 25kW x 10,000 points) does not exist

Emerging trends

| Category | Preference | Rationale | Learning |

|---|---|---|---|

| Primary Location of Charging | Most EV owners do over 80% of the charging at home and office. | People spend nearly 10-16 hours at home and office, which is enough time to get enough charge for a day's usage (30-50 km). | Manufacturers providing Level 2 chargers (4-18 kWh) for home charging will experience a demand surge from e-4W and e-2W users. |

| High Demand Locations for PCS | Most utilized PCS (Public Charging Stations) tend to be at exits of national highways. | Charging requirements for personal vehicle trips on long travel (>200 km) currently often require a 15-30 min stop to extend the range. | PCS with fast charging (>22 kWh) are best positioned to suit the needs as witnessed from Tesla's higher customer satisfaction score from its superchargers. |

| Swapping vs Plug In | Swapping is preferable only for 2W and 3W commercial use cases. | Light EVs are equipped with low range batteries and do not match the requirements for range and charge speed for daily usage in commercial use cases. | Battery manufacturers/OEMs with swapping stations within major metro and Tier-1 cities are in a favorable position. |

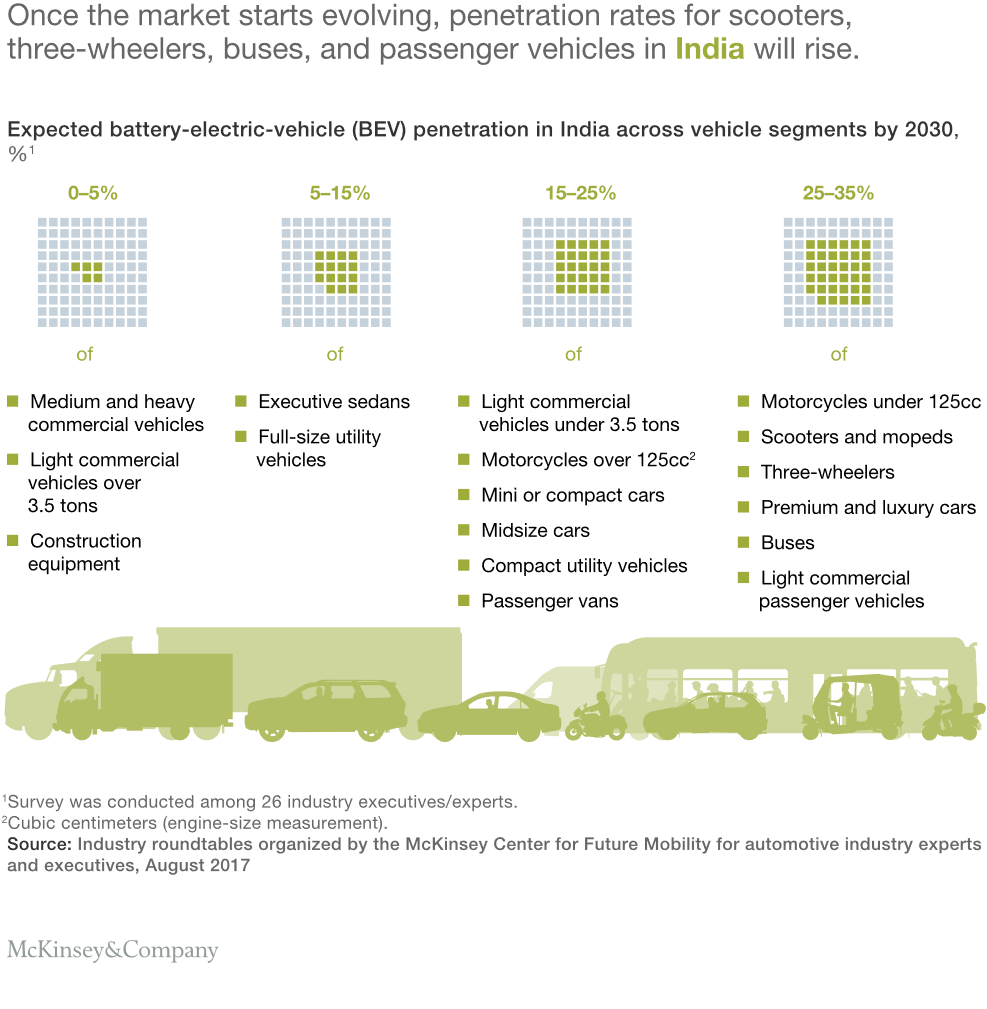

McKinsey's Report on state of EV market in 2030

Click on the link or Scan QR Code to read the McKinsey report

https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/the-future-of-mobility-in-indias-passenger-vehicle-market